The popularity of vegan and plant-based options has been on the rise in recent years, and Veganuary, a campaign that encourages people to try a vegan lifestyle for the month of January, has played a significant role in promoting this trend. Earlier this year, we covered the success or challenges this ‘campaign’ / lifestyle faced during our Cost of Living crisis. However, a few months on, what is the real appetite for Veganism in the UK? We analyse the sales data for frozen meat-free substitutes and plant-based chocolate for the year 2023 and have uncovered some interesting insights.

Frozen Meat-Free Substitutes: Rising Sales and Declining Prices

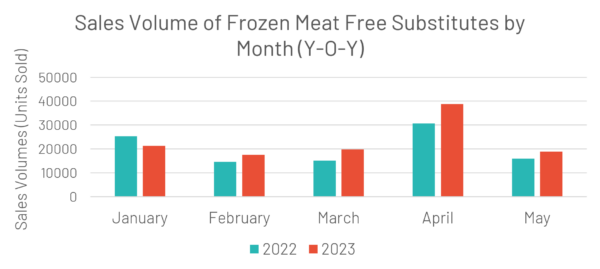

Sales volumes of frozen meat-free substitutes have experienced a notable increase year-over-year (Y-O-Y) for the brand in question. In 2023, sales volumes have risen by 14.55%, with an additional 14,779 units sold across Tesco stores year-to-date. Every month, except for January, witnessed higher sales volumes in 2023 compared to the previous year.

April stood out as the month with the highest sales volumes for both 2022 and 2023, reaching an impressive 38,774 units in 2023. Price promotions across stores likely contributed to this surge in sales. March, on the other hand, saw the highest sales volume uplift for 2023 to date, with a substantial increase of 30.85% from 15,119 units to 19,783.

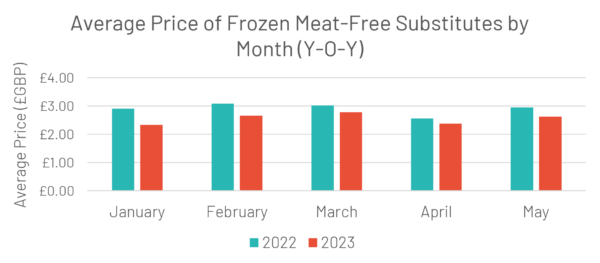

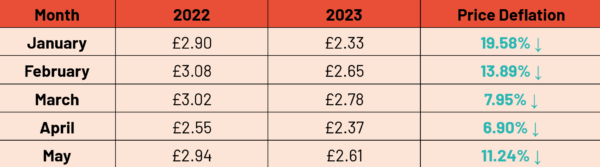

Despite the food and non-alcoholic drink category experiencing price inflation of over 19%, the average price of frozen meat-free substitutes has declined by 11.91% in 2023 compared to 2022. January witnessed the highest rate of price deflation, with prices dropping by 19.58% (57p per unit), even though it was the only month to see a decline in sales volumes. Increased competition and new product launches in the meat-free market during Veganuary may have led to promotional pricing.

Average Price (£) of Frozen Meat-Free Substitutes Y-O-Y by Month & Y-O-Y Deflation Rate (%):

Plant-Based Chocolate: Surging Demand and Marginal Price Decline

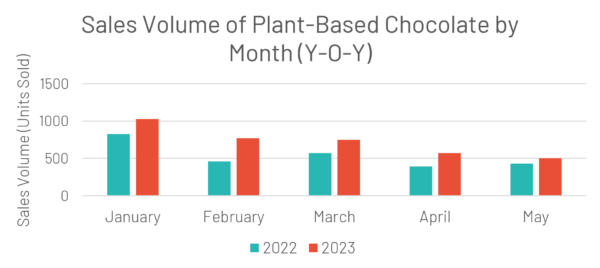

Plant-based chocolate, another popular vegan product, has experienced a significant increase in average sales volumes for the brand in question. Y-O-Y, sales volumes have risen by an impressive 34.86% in 2023, with an additional 936 daily units being sold across Tesco stores year-to-date. Every month in 2023 has shown higher sales volumes compared to the same period in 2022.

January saw the highest sales volumes for both 2022 and 2023, with an average of 1,025 daily units sold in 2023. This increase can be attributed to the introduction of a new product and an expansion of product ranging from two to three options, as demand for plant-based chocolate grew.

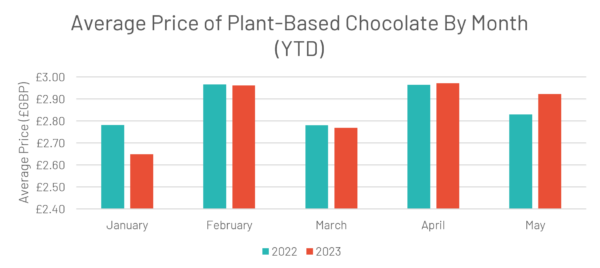

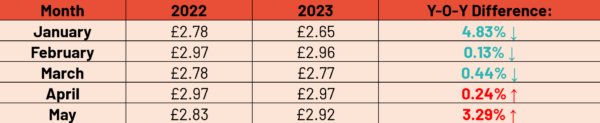

Interestingly, despite the overall inflationary trend in the food and non-alcoholic drink category, the average price of the brand’s plant-based chocolate has only slightly declined by 0.35% in 2023 compared to 2022. January again stood out with the highest rate of price deflation at 4.83% (13p per unit). Price promotions may have been utilised to promote the new product launch. In contrast, May experienced the highest rate of inflation at 3.29% (9p), possibly indicating the impact of broader food inflation on the plant-based market.

Average Price (£) of Frozen Meat-Free Substitutes Y-O-Y by Month & Y-O-Y Deflation Rate (%):

Conclusion

The analysis of sales data for frozen meat-free substitutes and plant-based chocolate highlights the increasing demand for vegan and plant-based options among consumers. Despite price inflation affecting the food and non-alcoholic drink category, these products have witnessed either stable or declining prices. The success of Veganuary and strategic product launches have undoubtedly contributed to the growth of these markets. As more brands enter the meat-free and plant-based sectors, competition is intensifying, resulting in price promotions and improved product offerings for consumers.

Get ahead of the data and maximise your sales potential

Understanding sales trends and consumer behaviour is crucial for planning future strategies and maximising your success. We specialise in providing comprehensive sales analysis and strategic insights to help businesses like yours thrive in the dynamic market.

Contact Reapp today and together let’s plan for your business’s future success

Source: Tesco data only, 1 chocolate brand and 1 meat-free brand

Data from 1st January – 29th May for 2022 and 2023