The Importance of Easter for Confectionary Brands

The Easter period is a crucial time for confectionary brands, with customers looking to buy sweet treats for themselves and their loved ones. But following our run up report last week, which out of the luxury and budget brands came out on top over the Easter period?

Luxury Brand Performance: Uplifts, Price Increases, and Regional Variations

Let’s start by looking at the performance of the luxury brand. Our data saw a year-on-year uplift of 52.99%, with Easter week showing an uplift of 175.38%. The brand’s Easter confectionery also saw a year-on-year uplift of 55.71%, although there was an average price increase of 10p per unit (2.98%) year-on-year. The Easter egg saw a year-on-year uplift of 35.45%, but there was a price increase of £3.08 per unit (44.92%) year-on-year. It’s worth noting that uplifts were observed across all UK regions.

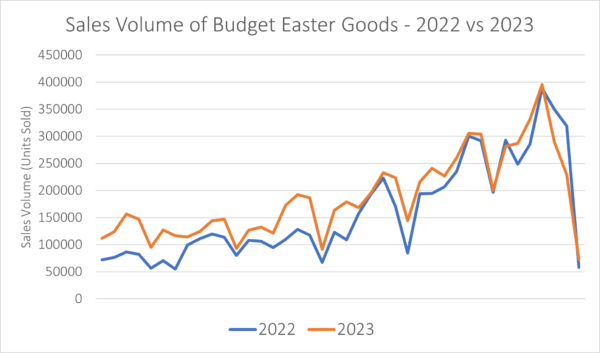

Budget Brand Performance: Uplifts, Price Increases, and Price Promotions

On the other hand, the budget brand also saw a year-on-year uplift of 17.21% during the Easter period, with Easter week showing a year-on-year uplift of 2.38%. Easter confectionery saw a year-on-year uplift of 29.35%, but there was an average price increase of 5p per unit (4.97%) year-on-year. The Easter egg saw a year-on-year uplift of 9.67%, but the average prices declined by 14p per unit (3.20%) year-on-year. It’s also worth noting that the budget eggs were on price promotions, which suggests retailers were keen to minimise leftover stock post-Easter 2023.

Y-O-Y Budget Easter Confectionery Sales by Region:

| Region | Y-O-Y Budget Brand | Y-O-Y Luxury Brand |

| East Midlands | 22.05% ↑ | 16.00% ↑ |

| East of England | 24.31% ↑ | 0.93% ↓ |

| London | 11.20% ↑ | 6.57% ↓ |

| North East | 30.34% ↑ | 17.57% ↑ |

| North West | 21.92% ↑ | 25.97% ↑ |

| Northern Ireland | 23.06% ↑ | 34.82% ↑ |

| Scotland | 14.38% ↑ | 20.30% ↑ |

| South Coast | 34.26% ↑ | 14.12% ↑ |

| South East | 16.93% ↑ | 7.35% ↓ |

| South Midlands | 3.66% ↓ | 11.56% ↑ |

| South West | 39.03% ↑ | 5.19% ↑ |

| Wales | 19.42% ↑ | 12.61% ↑ |

| West Midlands | 42.64% ↑ | 29.58% ↑ |

| Yorkshire and the Humber | 38.10% ↑ | 2.25% ↑ |

With ongoing issues surrounding the Cost-of-Living crisis, retailers may have been concerned that customers may have opted for cheaper alternatives or avoid Easter altogether. However, data collected post event suggested customers bought earlier when they saw the price promotions on, in order to get their loved ones gifts for a lower cost. As a result, less budget Easter confectionery stock was left during Easter week, potentially forcing people to buy more luxury eggs, which would explain the surge in sales during Easter week for the luxury brand.

Retailers’ Adaptation to HFSS Restrictions and Early Purchases

Retailers seem to have adapted to HFSS restrictions for Easter 2023 by creating displays that still highly visible to consumers, despite these being in less prominent in-store locations. This included displaying Easter goods in the Seasonal Aisle/Middle Aisles were consumers walk through, displaying Easter goods within aisles themselves, placing price promotions on Easter goods to make the price more appealing and encouraging customers to buy earlier. Other tactics also included Easter displays at the end of aisles containing HFSS compliant products, make customers subconsciously aware of the upcoming Easter season.

Luxury Easter Goods: An Impulse or Last-Minute Purchase?

Reapp data from pre-Easter 2023 showed that sales of luxury Easter eggs were down in the lead up to Easter 2023, with sales of the same luxury brand down 36.72% from the 1st March – 1st April 2023. This raises the question – are luxury Easter goods more of an impulse purchase or last-minute purchase? Or is was there less selection on supermarket shelves for Easter week itself, with budget brands selling out as customers buy them whilst they are on promotions? Less choice may be making people buy what’s there, and with ongoing issues surrounding the cost of living, last-minute shoppers may have been forced to splurge on more expensive Easter gifts for their loved ones.

What’s clear from our data and presence in store is that retailers have adapted well to the HFSS restrictions. However, with the ongoing issues surrounding the cost of living both them and the brands much remain agile in their marketing tactics to ensure they protect the sales and margins, not just during seasonal events, but through the year.